This is the one that started it all.

One day at work I found myself in front of an empty white board in the lunchroom. It had been vacant and unused for months now, and I loathed its uselessness (other than an old newsletter)!

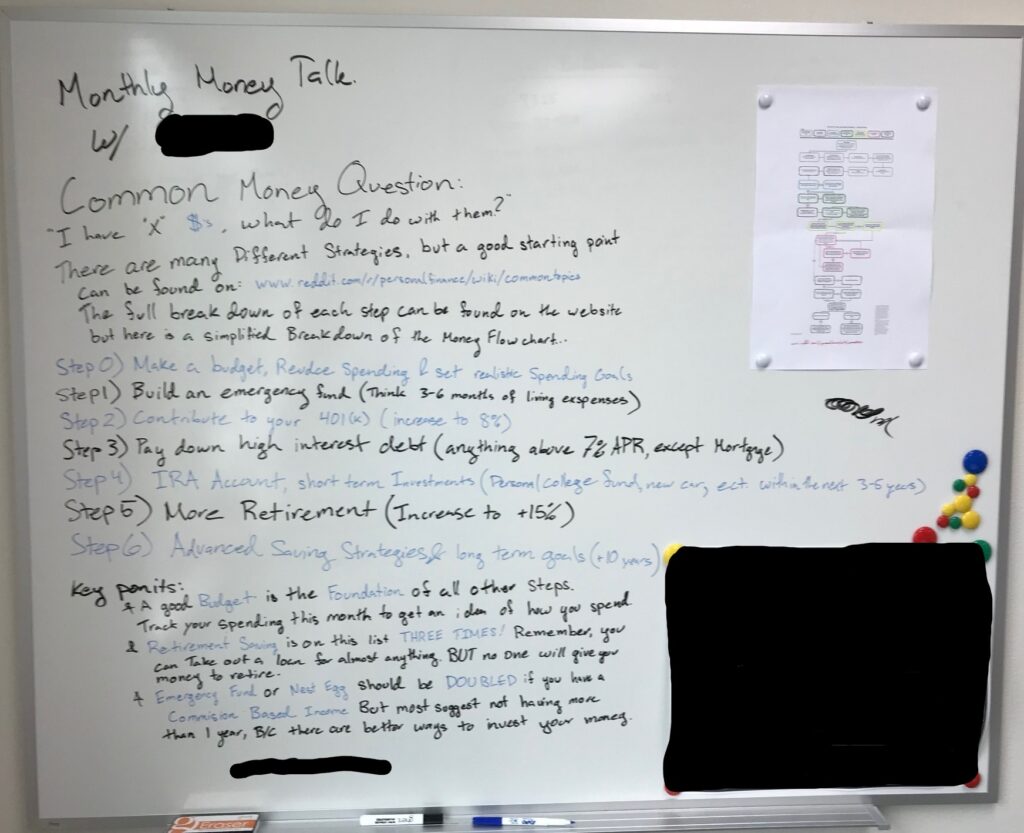

Suddenly I had the notion of writing down my thoughts and research on personal finance I had recently discovered. I thought it would be an interesting topic, as everyone likes money.

I wrote the title “Monthly Money Talks” because it had a nice ring to it, but also, I hoped that others would join in the fun and each month we would have a different author and a different topic.

Little did I know that I would be scripting and handwriting these “Monthly Money Talks” for the next year, all the while having wonderful discussions with colleagues which only served to fuel my thirst for knowledge.

Here is the first MMT ever, it was never typed out originally, so this is it’s maiden voyage on a keyboard. Please enjoy the original above, in all its glory.

Common Money Question:

I have ‘X’ $‘s, what do I do with them?

-Everyone

There are many different strategies, but a good starting point can be found here.

The full break down of each step can be found on the website but here is a simplified breakdown of the Money Flow Chart…

- Step 0) Make a budget, Reduce Spending & set realistic Spending Goals

- Step 1) Build an emergency fund (Think 3-6 months of living expenses)

- Step 2) Contribute to your 401(k) (increase to 8%)

- Step 3) Pay down high interest debt (anything above 7% APR, except Mortgage)

- Step 4) IRA Account, short term Investments (Personal College fund, new car, etc. within the next 3-5 years)

- Step 5) More Retirement (Increase to +15%)

- Step 6) Advanced Saving Strategies & long term goals (+10 years)

Key Points:

*A good Budget is the Foundation of all other steps. Track your spending this month to get an idea of how you spend.

*Retirement Saving is on this list THREE TIMES! Remember, you can take out a loan for almost anything. BUT no one will give you money to retire.

*Emergency Fund or Nest Egg should be DOUBLED if you have a Commision Based Income But most suggest not having more than 1 year, B/C there are better ways to invest your money.

~Enjoy, MMT~

P.S.

This is where we start our journey. It will take some time to upload all the original MMT’s, but once that is complete, I plan on continuing the tradition. I have learned and grown much since this last post and I hope you can appreciate the ride.

-MMT